Stroud Housing Commons

We want affordable, well-maintained houses and secure tenancies.

Houses in a housing commons are owned by the community in perpetuity, ensuring affordability and security of tenure.

Why this matters

The current system of home ownership and private rental isn’t working, because:

- Rent and home prices keep rising faster than wages, making it harder for people to afford a stable place to live.

- Properties are treated as investments, driving prices even higher.

- There aren’t enough public or cooperative housing options, leaving many people at risk of losing their homes or living in unstable conditions.

- At the same time, new developments focus on making profits over community needs.

This system deepens inequality and makes housing insecurity worse for millions.

Our solution

- A housing commons removes homes from the market forever.

- Instead of relying on bank loans, properties are purchased without debt, and the money that would have been paid as interest is shared between investors and tenants.

- Over time, rents reduce to a minimal maintenance level as investors are repaid, making housing permanently affordable.

- This model ensures secure homes for future generations.

How it works

By removing housing from speculation and eliminating debt-driven costs, we make stable, secure homes a reality. BUT HOW DOES IT ACTUALLY WORK? Explore the sections below to see how we fund, own, and manage homes differently—creating a fairer system that puts people before profit.

What is a Housing Commons?

A housing commons buys and lets housing, but organises management, rents and investor returns in a more equitable way than the current system. Instead of landlords or banks controlling homes, a housing commons allows the community to own and manage them collectively. Unlike traditional housing that gets more expensive over time, a housing commons ensures homes become more affordable over time, rather than less.

How is it different from regular homeownership or renting?

- Unlike private homeownership, houses are never sold again. Unlike homeowners, tenants don’t benefit from rising house prices, but neither do they pay maintenance or upkeep costs. They also have the right to pass on the secure tenancy to a family member – so a house can stay in the family (and no inheritance tax).

- Unlike renting, residents have security—they won’t be evicted for profit-driven reasons.

- As investors are repaid, rents fall gradually to the cost of maintaining the houses and the management of the scheme.

How do we buy the homes?

Instead of a mortgage, we raise funds from community investors by selling future rent vouchers.

- The vouchers are an inflation-proof savings tool.

- What would have been interest payments to the banking sector is shared between investors and tenants.

- They are sold at a discount to investors.

- They are bought by tenants in exchange for accommodation.

- The community investors get around 5% profit. Tenants get a similar reduction in rent.

How does this keep communities strong?

A housing commons prevents displacement and keeps people in their neighborhoods.

- No more evictions due to spiralling rent increases or landlords selling properties.

- Residents have a say over their housing and decisions are made collectively.

- It circulates the money in communities and stops wealth extraction.

- Over time, houses in the commons will become the most affordable and well-maintained houses in their communities.

What happens to rent over time?

Rent doesn’t keep increasing—it gets lower.

- Rent will remain slightly cheaper than the market rate for some years. This covers repaying community investors and maintenance costs.

- As more houses are put into Housing Commons, the economies of scale will enable rent rebates which will reduce the rent more.

- Like paying off a mortgage, as investors are repaid, rent reduces to cover maintenance of properties and management of the scheme, making housing permanently affordable.

Can commons housing be sold?

No, commons houses stay in the housing commons forever.

- No one can flip a home for profit, preventing speculation.

- If someone moves out, the next resident pays the same fair price, keeping housing affordable.

What’s in it for the investors?

Small-scale investors can put their money in places they care about and help create affordable housing while earning a reasonable return.

- Instead of banks profiting, investors get repaid over time with a fair return.

- It acts as a pension alternative that’s safe, local and ethical.

- Once repaid, the home stays affordable forever, benefiting future residents.

Knowledge bank

Introduction

Who we are and how to contact us

A group of Stroud residents have come together to launch a housing commons in Stroud. Some of us are looking to become tenants, some investors, and some stewards (employees – managing the scheme and maintaining properties). But we’d all like to see a better housing system in this country, with affordable, well-maintained houses with secure tenancies – and we’re excited by commons ideas.

If you’d like to get involved, either as a prospective tenant, investor, steward or volunteer, please read the information on this page, and get in touch.

Why housing commons?

The private housing market is broken – in the UK, and in most of the developed world. Home-buyers are forced into a speculative market, decades of debt slavery and insecurities around repossession if they lose a job or interest rates skyrocket. Private rents are so high that many have given up hope of owning their own home. This system benefits banks and their shareholders. After 25 years of mortgage repayments, a homeowner will end up paying a lot more than the initial value of the house. But a tenant in the same house, over 25 years, will end up paying more than double the initial value. It’s a guaranteed way of increasing wealth inequality.

The commons solution is to take houses off the market by purchasing them as a community, without incurring debt. Housing commons is a way of providing good-quality, affordable housing with secure tenancies. Homes are owned by the community in perpetuity, not by individuals, businesses or the local authority. The commons allows young people to stay in the community they grew up in. Parents can ensure a secure home for their kids by passing on their tenancy.

More on solving the housing crisis with housing commons

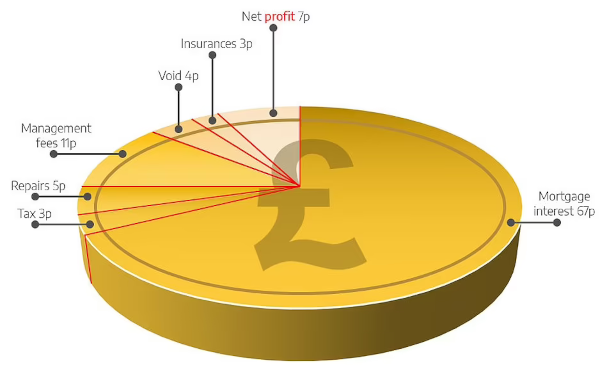

Where the rent goes on rented housing: most goes to the mortgage company.

The basic concept

A housing commons is an association of 4 member groups: tenants, investors, stewards, and a ‘custodian’ group (see below) with a veto vote to ensure that commons principles are adhered to, and that houses are never sold out of the commons. The commons group issues rent vouchers that can be redeemed for accommodation in commons housing. Vouchers are purchased by investors and/or tenants, and the cash raised is used to purchase more properties. This avoids debt to the banking system.

More details

The financial model

Vouchers are issued by the housing commons group for use as rent in one of their properties. A house is purchased by a local housing commons group with cash, provided by investors, who in return are given 25 years’ worth of discounted vouchers.

Vouchers are not denominated in the national currency, but in square metres of the minimum standard of local property that can be rented. More desirable properties (in terms of location, condition, parking, garden, view etc.) are priced at more vouchers per square metre. This makes them attractive to investors, because they’re inflation-proof (a square metre can’t shrink over time in the way that the value of the national currency can).

The crucial thing to remember is that in the current system, after 25 years of mortgage repayments, a homeowner will end up paying a lot more than the initial value of the house. But a tenant in the same house, over 25 years, will end up paying more than double the initial value. So 25 years’ worth of vouchers for a property will be worth quite a lot more than the value of the property. This is the concept that makes the model viable.

The housing commons group

A housing commons group is an association with different classes of member – including tenants, investors, stewards (members who are paid to manage the scheme and maintain the properties) and ‘custodians’ (see below). Tenants are the biggest member class, with most of the votes. Anyone holding vouchers must be a member of the housing commons group, which is how groups can democratically prevent anyone from cornering the market in vouchers and extracting profits from the community.

A local housing commons will have a relatively tight geographical area (to make maintenance of the houses easier – the steward group and/or local builders / plumbers / electricians will be on call to service a group of local houses at short notice if needed). The average size of a housing commons might be around 100 properties. This provides economies of scale for management and maintenance etc, but it’s still small enough for good social relations and commons governance.

For any house, there are never more than 25 years’ worth of vouchers in circulation, and they can only be issued for houses that the commons group owns, and are in good enough condition to be rented out. The group pays for maintenance of the properties from the rent income.

Although the commons group will get slightly less than market rent for their properties (because they issue vouchers at a discount), they’ll still be better off than commercial landlords, because they don’t have any debt. Over time, the surplus that they generate through having no debt can be redistributed back to tenants as rent rebates, to keep rents affordable.

House-sellers

Anyone can sell a house to the commons. The seller is happy because the commons group is a reliable, cash buyer and from a seller’s perspective, there’s nothing unusual about the purchase. Sellers who receive cash for their house are not investors and therefore not members of the housing commons group. However, if they don’t need cash to buy another property straight away, they could, instead of taking payment for their property in cash, take vouchers, and become investors themselves. This probably won’t happen often until the housing commons is well-established, but as voucher holders and therefore investors they’ll then be members of the housing commons group.

‘Custodians’

There’s also a ‘custodian’ member class, who don’t propose anything, but have a veto vote. There are some core commons principles – for example around evictions without due process, profiteering, selling property out of the commons etc. They’re disinterested arbiters to make sure that the purpose of the commons isn’t compromised – if the custodians see proposals that go against commons principles, they can veto them. Custodians could also, for example, stop tenant members setting the rents too low, which would undermine the model by deterring investors. Think of custodians as trusted ‘village elders’.

Other sources of information

- Introduction to the housing commons, by Dave Darby of Lowimpact.org

- A brief introduction to commons housing, by Dil Green of Mutual Credit Services

- 4 stories, from the perspecive of seller, tenant, investor and housing commons group

- Imagine…

- Solving the housing crisis via the commons, part 1: the housing crisis

- Solving the housing crisis via the commons, part 2: how the housing commons can solve the housing commons

Roadmap & news

We’re finalising the association agreement and tenancy agreement for the first tenants in the first housing commons house.

Here’s an article about that house, and the process of finding tenants. There were 42 applications, which we narrowed down to three, who we interviewed and made our final choice. It really wasn’t easy, as all candidates were great. In fact, one of the unsuccessful applicants has since joined the housing commons group, to help get more properties.

They’re moving in in March. Our steward Chris has done a great job getting new carpets, windows fixed, electrics checked, handrails internally and externally and some other maintenance jobs.

Later in 2025 we’ll produce a prospectus for investors, attract more investment, start to buy more houses and advertise for tenants.

Association agreement

We’re finalising our association agreement, after which we’ll post it here.

Direction, vision, ethics

Direction: Towards a community-owned housing sector in Stroud, providing affordable, good-quality homes with security of tenure, without debt to the banking sector, with strong asset locks so that houses are never sold out of the commons, and connected via the credit commons protocol to other commons sectors in Stroud, and housing commons groups in other towns.

Vision: A Stroud Housing Commons (SHC) with 100 houses, after which new groups to be founded in other parts of Stroud – so that there will be several, local housing commons groups in Stroud, not just one.

Ethics:

- A housing commons group ideally holds no more than 100 houses, after which, new groups can be formed to own houses in smaller geographical areas.

- SHC will purchase houses with cash raised from the sale of rent vouchers, issued by SHC.

- Rent vouchers are not denominated in the national currency, but in square metres of the minimum standard of local property that can be rented. More desirable properties (in terms of location, condition, parking, garden, view etc.) are priced at more vouchers per square metre (rental value is ascertained by a local valuer / surveyor).

- Investors (of cash or houses), tenants and stewards (managing the scheme and maintaining properties) will be full members of SHC.

- Anyone holding SHC rent vouchers must be a member of SHC.

- For any SHC house, there are never more than 25 years’ worth of rent vouchers in circulation, and they can only be issued for houses that the commons group owns, and are in good enough condition to be rented out.

- Affordability will be achieved by providing rent rebates to tenants after 2 years as a member.

- There will be a ‘custodian’ member class, comprised of a trusted member(s) chosen by the group, with a veto vote to ensure that commons principles are adhered to.

- SHC obtains income for maintaining the properties and providing rent rebates from re-selling vouchers redeemed by tenants.

- SHC will maintain properties to a high standard, with security of tenure for tenant members.

- SHC will purchase a range of housing types, including low-cost housing, to ensure affordability for all.

- Housing commons groups in different parts of Stroud, and in other towns, to eventually be connected together sociocratically.

Information for tenants

Please contact us (hello at stroudcommons dot org) if you’d like to be considered as a tenant of Stroud Housing Commons. You’ll be added to a waiting list and contacted when we have more properties. Here’s more information, and below is our tenancy agreement.

As a tenant, you can pay rent with cash, or you can buy rent vouchers – at a small discount, so your rent will be cheaper. The discount is worked out by the management committee of the housing commons group, and is possible because there’s no scarcity of vouchers, and no debt to repay. This provides affordability and security for tenants, in well-maintained, well-insulated, high quality properties that they’re actually co-owners of. If there’s a waiting list, the group can vote to prioritise local people in housing need.

There’s a marketplace for the vouchers (via an app – a bit like eBay). Investors put them up for sale, and tenants buy them. The interests of tenants and investors are aligned, in that investors want the rental value of the houses to remain high (to maintain the value of their vouchers); and although tenants want affordability, they also want good-quality housing (which makes sure the rental isn’t too low).

If you’re a numbers person, we’ll post a spreadsheet here soon that shows how the finances work out for a tenant, a seller, an investor and the housing commons group).

Tenancy agreement

We’ll publish our tenancy agreement here soon.

Information for investors

Please contact us (hello at stroudcommons dot org) if you’d like to be considered as an investor in Stroud Housing Commons. Here’s more information, and we’ll be producing a prospectus soon:

An investor could be anyone with spare cash that they’d like to invest in their local community. This might include people with a deposit for buying a house, that they realise is not going to be possible, and so they might decide to invest in a project that may provide them with housing another way – that also benefits their community.

Vouchers will never be the object of insane speculation and the creation of billionaires, as they’ll only ever represent rent on existing properties, which tenants can pay in cash if vouchers rise in price, and so they have limits in the real world. Investors can decide to hold on to vouchers as a longer-term, inflation-proof investment – maybe as part of their pension – or they could sell them on to other investors, or to tenants, who will buy them if they are slightly discounted.

Canny investors will realise that a housing commons group has a very healthy balance sheet. Its assets are solid – houses; and on the liabilities side is the requirement to provide housing to tenants, a month at a time. Housing is not like energy or food – it doesn’t have to be reproduced every month. A house just sits there, and needs occasional maintenance (which the investors won’t have to do themselves). They’ll see that 25 years’ worth of vouchers are worth significantly more than the house, and that the housing commons will acquire housing (that will keep rising in value), without incurring debt, which represents an attractive, safe investment – especially in a world of shrinking investment opportunities.

Investors don’t have to see every property – they’d just have to assess the portfolio and the management team. They have to trust that the group can attract tenants by managing the properties well, and choosing properties that people want to live in.

To start, the group finds a willing house seller and investors (who can invest either cash or a house), and sign contracts. Cash investors put money into an escrow account. Later, the money is moved from the escrow account to the seller’s account, and the investor gets the vouchers for that property. At this point the seller has the money, the investor has the vouchers, and the housing commons group has the house.

Legal agreements will be in place, stipulating that, in case of failure, the house will be returned to the seller or will be sold to reimburse the investor. But because there’s no debt, the house can’t be lost.

Prospectus

We’ll be publishing our prospectus for investors in spring 2025, and we’ll publish it here.

Information for stewards (employees)

Please contact us (hello at stroudcommons dot org) if you’d like to be considered as a steward of Stroud Housing Commons. This is a paid role. Here’s more information on the steward’s role.

Details of the steward’s role

- Maintain the structure and exterior of the property. Keeping it safe, presentable and free from dilapidation.

- Ensure the property is free from serious hazards throughout the tenancy.

- Fit / maintain / check smoke alarms on every floor and carbon monoxide alarms in rooms with fixed combustion appliances such as boilers, and make sure they are working at the start of any tenancy.

- Deal with any problems with the water, electricity and gas supply.

- Maintain any appliances and furniture supplied with the property.

- Carry out most minor repairs. Or arrange if beyond scope of carrying out safely and professionally using an approved contract.

- Arrange an annual gas safety check by a gas safe engineer (where there are any gas appliances).

- Arrange an electrical safety check by a qualified and competent person every five years.

- Consider requests for reasonable adjustments from tenants who have a disability or long-term condition. Reasonable adjustments could include changes to the terms of your tenancy or allowing adaptations or adjustments to the property or common parts of the building.

- Be first point of contact with tenants for the housing commons.

- Stewards must get permission from tenants to access a property and give at least 24 hours’ notice of proposed visits for things like repairs. These visits should take place at reasonable times – neither SHC nor contractor are entitled to enter a property without tenants’ express permission.

- Ensure the property is at a minimum of energy efficiency band E (unless valid exemption applies).

- Ensure the building is insured to cover the costs of any damage from flood or fire.

- Check regularly to ensure that all products, fixtures and fittings are safe and that there haven’t been any product recalls.

- Ensure blinds are safe by design and they do not have looped cords to prevent accidents.

- Collect rent monthly, record the transactions on the rent spreadsheet and issue receipts to tenants. Chase up any rent arrears and inform SHC of any issues in rent collection asap .

- Provide SHC with a bimonthly report on the status of the above points in a standardized template.

- Steward should show best value has been achieved for any contracted work above £xxxx by getting 3 quotes and sign off of preferred contractor by SHC.

- Steward to provide email summary of any works done including photos, short written summary and costs. With bimonthly report.

- A basic risk assessment should be carried out by the Steward before any works. Template for this provided.

- Spending permission thresholds. Steward can spend up to £100 in materials for work they carry out or up to £200 for contracted work without seeking approval by SHC. Above those thresholds, Steward needs written (text email etc) from 2 other members of SHC.

- Any holiday or period of absence will be unpaid by SHC to a Steward. SHC may appoint a temporary Steward to cover any time off or take on the role themselves temporarily.

- Should SHC not be happy with how the Steward role is being delivered they may put the role into review for an agreed period. Usually 2 months. If agreed changes are not made in this review person SHC may choose to end the employment of the Steward. Should the Steward wish to leave the role, they should give notice of 2 months.

- Additional tasks may be required as role develops. These to be added to the written role as they arise in agreeance with SHC and Steward.

Launching housing commons in other towns

When we have a small number of pilot projects, to show that the concept works, it will spread to more towns. This can be helped by forming groups of interested people who know their local area, including what local tenants need (student bedsits, small houses for older or single people, larger family homes etc.). Their role will be to find more people happy to invest in / sell property to the commons, and to find local people to put 5-10k into a local, secure investment pool. On the basis of that, the local housing commons will be able to begin to buy the kinds of housing stock required locally.

When Stroud Housing Commons is established, we’ll help interested groups to set up housing commons in their town. Town groups will be linked sociocratically with other towns at the county level, and so on up to the national level.

The legal structures around property are different in different countries, so the model will have to be built differently for each country. As the idea develops, groups will have to do the work to develop their model in line with local laws.

When the concept has been shown to work, and as fledgling housing commons start to grow in a range of communities, ordinary people selling a house will realise that the housing commons buying their house from them in exchange for vouchers is an attractive option, because the vouchers can be shown to be worth more than the market price of the house. We want to get to the situation, as quickly as possible, where sellers, investors and potential tenants are approaching housing commons groups, because the benefits for all parties are clear.

Once a market has been established, and word spreads, more people will transfer homes to the housing commons in exchange for vouchers, because it makes financial sense. Some people will even want to sell their house for vouchers and use them to keep living in it, because it removes the worry of insuring, repairing and maintaining the property. Estate agents and letting agents will change the way they work – otherwise, as the commons grows, they’ll lose business.

A national, regulated, ethical, mutual investment fund could be set up, to invest in commons groups everywhere. Specialist ethical financial institutions could help design a fund. Many people would like to invest in their community, but there’s no low-risk, well-managed, simple way to do it. Each housing commons group will remain small and locally-focused. Scale will be achieved by federating local groups into district networks, which will be federated into regional networks, which will be federated into national networks. This will build resilience, communities of good practice, and allow people to move from one area to another, and swap vouchers.

Housing Commons Society

This will be a national body whose job is to make sure that local housing commons groups stick to the core principles. It can appoint / train / vet local custodians. This body researches trends that will affect the housing commons (including govt. policy), creates guidelines on how to respond to them, and provides arbitration for conflict resolution.

Local groups pay a small membership fee to the society – or there might be system of social franchises. Local groups are autonomous, but subscribe to the models developed by the society. If any local housing commons group fails (although without debt, they should be robust), the national society will step in to ensure that housing is provided and maintained for vouchers, while working to re-establish good local management with the commoners.